Machine Learning in Finance: High-ROI Use Cases and Investment Insights

Introduction: Why Investors Should Care About ML in Finance

The finance industry has always been driven by data. In 2025, the game-changer isn’t just big data—it’s machine learning (ML). Banks, hedge funds, and fintech startups are investing billions into ML systems to forecast markets, detect fraud, and personalize financial services.

For investors, understanding machine learning in finance isn’t optional—it’s the difference between catching the next wave of innovation or missing out on high-growth opportunities.

The Role of Machine Learning in Modern Banking & Investments

Machine learning has shifted from being a “tech experiment” to becoming the core engine of financial decision-making. Unlike traditional analytics, ML systems continuously learn from new data, making predictions sharper over time.

Where ML is transforming finance today:

- Banking: Automated credit scoring, personalized lending offers, fraud monitoring.

- Investments: Algorithmic trading, robo-advisors, and portfolio optimization.

- Insurance: Risk profiling and real-time claims fraud detection.

- Fintech: Customer-centric apps delivering instant, AI-powered insights.

This isn’t a niche trend—it’s the mainstream future of finance.

High-ROI Use Cases Driving Growth

1. Fraud Detection & Risk Management

Machine learning models excel at spotting suspicious transactions in real time. Unlike static rules, ML adapts to evolving fraud patterns. This saves banks billions and keeps customer trust intact.

2. Algorithmic Trading

Hedge funds rely on ML-driven quantitative trading models to process massive datasets, from stock prices to social media sentiment. These algorithms can execute trades in microseconds—generating higher returns while reducing human error.

3. Credit Scoring & Loan Approval

Traditional credit scores miss nuances in borrower behavior. ML-powered scoring uses alternative data (such as spending patterns, digital footprints, and mobile payments) to assess risk more accurately, opening new lending markets.

4. Robo-Advisors & Wealth Management

AI-driven robo-advisors democratize investing by providing low-cost, automated portfolio management. They adjust strategies based on market shifts, offering investors more efficient growth opportunities.

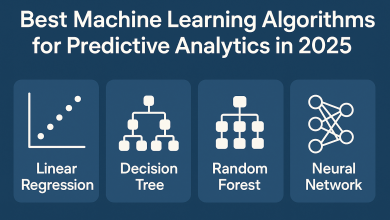

5. Predictive Market Analytics

By analyzing historical data, global events, and sentiment, ML models help investors forecast trends. This predictive edge boosts ROI in trading, asset management, and venture capital.

How to Evaluate ML-Driven Fintech Startups for Investment

Investors flock to fintech startups, but not all ML-driven firms are created equal. Here’s how to evaluate them:

- Technology Stack: Do they leverage proven frameworks (TensorFlow, PyTorch) and scalable cloud platforms (AWS, GCP, Azure)?

- Data Strategy: ML thrives on quality data. Does the startup have access to unique or proprietary datasets?

- Regulatory Compliance: Are they aligned with GDPR, CCPA, and financial regulations?

- Scalability: Can their models handle growth as user demand spikes?

- Competitive Edge: Do they provide value beyond traditional banking solutions?

Smart investors seek startups with both innovation and regulatory readiness.

Risk Factors: Regulation, Market Volatility, Data Ethics

While ML in finance offers huge potential, investors should weigh the risks:

- Regulation: Governments are tightening controls on AI-driven financial decisions. Stricter compliance may raise costs.

- Market Volatility: Over-reliance on algorithms can backfire in “black swan” events, where human judgment still plays a role.

- Bias in Data: If training data is biased, ML can amplify inequality in lending and investing.

Balancing ROI with responsibility is the key challenge for financial innovators.

Long-Term Trends: AI-Powered Wealth Management

Looking ahead, ML will merge with other technologies like blockchain and quantum computing, creating even more powerful financial systems. Expect to see:

- Personalized, AI-driven financial planning

- Real-time global trading platforms powered by ML

- Hybrid AI-human advisory services for high-net-worth clients

- Quantum-enhanced algorithms that outperform today’s best ML systems

Investors who understand these shifts today will profit from the finance industry of tomorrow.

Conclusion

Machine learning in finance is no longer futuristic—it’s the present reality driving ROI across fraud detection, trading, lending, and wealth management. For investors, the opportunity lies not just in adopting ML but in identifying startups and financial institutions that harness it responsibly.

High-ROI use cases are here to stay, but the smartest investments balance innovation with compliance, ethics, and long-term scalability. The winners will be those who combine data, technology, and trust to reshape finance.

1. What is the biggest use case of machine learning in finance?

Fraud detection and algorithmic trading are currently the highest-ROI use cases.

2. Can ML replace financial advisors?

Not entirely. Robo-advisors offer automated services, but human advisors still add value for complex decisions.

3. Is investing in ML-driven fintech startups profitable?

Yes, if startups have strong data strategies, regulatory compliance, and scalable models.

4. What risks does ML bring to finance?

Regulation, algorithmic bias, and market volatility are major risks.

5. What’s the future of ML in finance?

AI-powered wealth management, quantum-enhanced trading, and personalized financial services will dominate.